Pemex is infected with COVID-19, does social distance apply?

COVID-19 arrived in Mexico and, eventually, it has infected PEMEX, the state-owned company (NOC), which, at its best, has been «pillar of the Mexican economy», such as in the early 1980s when, That single company generated 60% of government spending.

The same that after many abuses and deviations, is overwhelmed by the ravages of a frustrated Energy Reform that sought to turn it into a Productive Company of the State, in times of decline of the global oil industry, combined with bad decisions and administrative policies, for which it did not reach the expected results as a State Productive Company and, is currently an older adult, 80 years old, with cancer, obese, anemic and penniless.

Is an abused and dispossessed older adult

As an 80-year-old man, he owns deteriorated assets, about to complete their life cycle and among these, he has facilities, equipment and pipelines that require maintenance and, quite often replacement, which is currently more difficult as a result of the anarchic growth of populated areas and by multiple changes and, updates in legislation, mainly related to environmental and individual rights.

Among the most important negative consequences of this circumstance are:

- Accidents and spills that affect villages, settlemens, cultivated areas, access roads, in the proximities of the facilities.

- Deferral / cancellation or cost overruns of assesment updates, stimulations, reentrances in wells and fields due to difficulties / limitations of passage / access through currently (but maybe not originally) populated areas.

- Proliferation of clandestine intakes and, hydrocarbons robery (known in Mexico as Huachicol), which in 2018 reached volumes of 56,000 barrels per day and was carried out, even within the company’s own maneuvering yards and plants. And, that is why Mexico has allocated a significant amount of resources to control this illicit; reporting the closure of more than 13,000 clandestine intakes was reported, and a 91% reduction in fuel theft to an average volumetric loss, currently, an average estimated at 5,000 barrels / day despite the continuous National Guard pipelines and facilities surveillance, by the end of 2019.

Has anemia and lives on public assitance

Pemex is anemic because he was a young man who generated great wealth for the whole country. But in his most productive years government has bled him out.

No government ever fed Pemex. He paid more than 60% for exploration and extraction rights, more than 36% in income, special and other taxes. And, even more, all the wealth generated by Pemex was usufructed by the treasure of the Mexican Nation. Pemex has never received a penny from the sale of its hydrocarbons it extracts or from the petroleum it produces or processes; All that benefit goes to the Treasury and should have been used to build roads, schools, hospitals, public works and community benefits.

In such a way that Pemex does not receive payments, much less profits and, to execute its projects, it only gets what Deputies and Senators approve in the form of an annual budget, in the Congress of the Union, where it competes against social programs, housing, health, education, security and others.

COVID-19 impacts its productivity and its economy

It’s a bad thing, in contingent scenarios such as the one currently faced, all the world governments are obliged to assign extraordinary resources to face the COVID-19 Pandemic, which is why Congresses and tax authorities adjust budgets and reallocate resources to prioritizing spending accordingly to the most urgent needs as investing in:

- Health

- Food

- Security

While all other projects and development lines, including those of Pemex, become secondary and, their originally assigned budgets which have not yet been exercised (projects not yet executed) are the first adjustment targets or «cut back” to free up those resources and reallocate them to the new contingent priorities.

Mexican recent history shows us recurring cases in which contingencies (Quake ’85; Fall of the Oil Market ’86, Pandemic A (H1N1)) imposed excessive cuts which decapitalized Pemex, however, as an immediate alternative, it was authorized contracting credits using its intangible assets (reserves) as guarantees.

Even worse has been that the crisis has been compounded by poor planning, alleged cases of corruption, currently under investigation and, laxity of the latest administrations, which currently places Pemex as the world’s most indebted oil company with an amount around of $ 102 MM USD.

Maintains too many unproductive children and grandchildren

The old and obese Pemex has a heavy burden of administrative vices and an enormous bureaucratic apparatus and, He maintains too many unproductive children and grandchildren personified by an unproductive mass of 128,000 employees, made up, mostly of overburdened crews and reserves of union workers and representatives and, huge labor liability.

This heavy burden for any company becomes even more dense and threatens to sink Pemex further since in this COVID-19 Contingency, only operating personnel keeps working actively and, without having an even approximate figure, It migh be estimated that is less than 30% of the staff, while the rest (technical-administrative staff of non-substantive functions, over 60 years old and, with conditions that might increase infection risk), by official regulations, are at home, desirably abiding by the provisions of hygiene and social distancing.

Nonetheless, these actions aimed at safeguarding the health and integrity of workers will have a serious economic-financial impact on the company, which will undoubtedly see a deferral in its goals of incorporating reserves, operations slowdown because there is a supplies flow reduction and, strengthening of protocols and security measures in facilities.

Likewise, given the limitation to access some computer tools and data, technical personnel will be forced to defer, at least, the generation of some of the plans and programs of its fields and wells interventions, equipment movements and, subsequent drilling locations. While this happens in a low oil prices scenario; equipment and tool rents are running, loan repayments are growing, salaries for active and confined personnel are running, therefore, we can expect the coverage contracted to ensure guarantee prices for this year, if they reach us now, they will rise excessively for the next, therefore, the company has seen the rating of its debt bonds falls.

Even though, some specialists postulate a possible price rebound for the Futures Market in which the MME reaches up to $ 24 USD for next June, we do consider that the accumulated losses along these months of COVID19 and the projected internal budget with guarantee prices of $30 USD, such an expected increase, even if another seasonal increase occurs above $30 USD for the last months of this year due to the entry of winter, will not give us enough to make up for what we have lost.

Pemex has cancer and its tumors weaken it further

In whichever company, unproductive assets represent liabilities and when those liabilities are too many, the load can represent significant financial burdens, in Pemex particular case, due to lack of investment in plants, pipelines, facilities, as well as the fields themselves and, almost the whole range of Assets, have been exploited with little or no maintenance and each one of these, once their useful life has expired, is included in the list of liabilities.

What is even more serious, in Pemex old age and its lack of ability to face COVID-19, is that budgetary limitations, bad policies and bad administrative decisions have led to lack of mainttenance and deterioration of many assets that are no longer sufficiently productive and added to a large number of low productivity fields that, in the current scenario of low prices in the global O&G industry, fall well below their equilibrium point due to their loss of productivity, and that reflects into an excessive growth in The list of liabilities which raises the administration spending and, in the case, of facilities and fields, it also imopacts maintenance, abandonment and, restoration costs.

However, decisions cannot and should not be made lightly, each one of the Assets must be specifically assesed, with objective criteria, consider their real value, their useful life and market projections to reallistically determine their future profitability and their best performance. moment in the market and, it should be taken into account that Pemex, today, has a large number of mature fields that urgently demand:

- Re-evaluaciones: Taponamientos y cierres temporales.

- Stimulations.

- Reentrances: Enhanced Oil Recovery (EOR).

All this is technically viable: in the first instance, the fields Pemex kept for itself in Round 0, should have enough remaining reserve and, therefore, they should be able to extend their productive life for about 30 more years, starting from when they were self-assigned.

Additionally, Pemex has exploration areas On shore and Off shore shallow waters, with 2P and 3P Reserves enough to replace production in the coming years, so that He might even increase its production platform, as far as it were supported by an intense exploration program which ensures finding new reserves volume, enough to replace consumption.

On the other hand, in the Industrial Transformation branch, Pemex currently has 6 refineries, in Salamanca, Minatitlán, Tula, Cadereyta, Salina Cruz and Cd. Madero, they all together have a nominal current capacity, to process 1.6 Million barrels / day which is equivalent to what some refer to as the average daily stabilized production; the same that some others report around 1.73 MM bpce / d, but due to plants poor condition and lack of maintenance, they are currently working, on average, at 40% of their capacity.

In mid-2019 Pemex announced an initial investment of $ 25,000 million MXN (> $ 1,000 million USD) to start the rehabilitation of those refineries and, eventually, put them to full capacity in about two years, however, in the optimal case of compliance with programs, which seems remote, given the currently imposed slowdown by the pandemic itself, those refineries should eventually demand a volume of Hydrocarbons equivalent to the total current stabilized production or just a little under the highest production rate achieved for March.

Although Pemex foresees a production increase for 2020, we cannot ignore that last 2019 it faced difficulties in achieving its reserves incorporating goals and, also to increasing its production platform, mainly due to delays in drilling and completion of wells times, but beyond of speculations, in the supposed and desirable case of achieving expected production increase, even up to 2’000,000 bpce / d, even in the O&G low prices scenario, it should not be an easy decision to allocate more than 75% of production for domestic consumption and sacrifice the commercialization of the Mexican Export Mix which currently generates 17% of fresh money for government spending.

The largest tumor is an implant

In addition to the administrative and bureaucratic burdens, operational challenges and budget limitations of Pemex, the construction of a new refinery in Dos Bocas, Tabasco, was announced, with an initiall investment estimated at approximately $9,000 million USD and, a very limited construction time of 3 years, trimed now by the months of COVID19 slowdown, an ambitious megaproject that has been widely argued, taking into account the following premises:

- It is a project, at best, in the short to medium term (3 to 5 years) of execution and an extremely long ROI (over 20 years accordinglly to specialists).

- Distracts resources that can be invested in a productive, wealth-generating area (PEP projects with high VME and short ROI).

- It commits to its operation, production volumes that are not available, at the same time that consumes the economic and financial resources necessary to incorporate reserves and to reach the levels of stabilized production that would represent an additional volume of 340,000 bls of Maya Type heavy crude.

- Commited production is additional to the 1,615 MM barrels / day that the other 6 refineries should demand, if they were processing crude at 100% of their capacity, that means additional to the current Production rates.

The foregoing, assuming that processing such accumulated volume will be sufficient to produce the 1,371 MM barrels / day of petroleum products (Gasoline, Diesel, Fuel Oil and Jet Fuel) which represents current derivatives demand, should also cover projected future demand.

However, this scenario would place us in a production deficit so, and we should be obliged to import more crude oil, only to satisfy our internal market, at the same time that we would sacrifice 100% of income from sales of our crude oil export and with it, the entry of fresh money into the coffers of the nation.

CONCLUSIONS

- Pemex urgently requires reorienting its strategy towards its most profitable and wealth-generating projects, assesing its best time to enter or exit the market, but these are necessarily: the most profitable production projects and the projects with the lowest risk of exploration.

- In the Industrial Transformation branch, it is convenient, by national strategy, to complete rehabilitation of the 6 existing refineries and to increase their refining capacity with a modular approach, as production grows and, the ability to ensure the supply of crude oil, without sacrificing the possibility of incoming fresh money while replacing crude oil exports with other oil derivatives exports.

Fortunately, COVID19 is not necessarily deadly, Pemex was at the same risk of becoming infected as many other younger companies in O&G and, any other branch of the industry, as an example, those which are exploiting Shale and maybe they are not obese but, yes they are under pressure from their high costs of production, financing and amortization of debts that have some of them on the verge of collapse. But in the case of Pemex there is still some kind of cure:

- The first measure is Social Distancing.- stop distracting budget in projects that are not productive in the short term, that is, focus on the areas of:

- Maintening and Enhancing Production.

- Low Risk Exploration for Field Delineation, Reservoir Extension and Reserves Incorporation.

- Maintenance / Rehabilitation of existing Refineries.

- Deferral of the New Refinery Construction to ensure production enough to operate already existing refineries and to guarantee their continued operation.

To prevent the entire country from suffering an epidemic:

In the field of national energy policy:

While it is true that PEMEX was once and, for a long time The Pillar of the Mexican Economy, it is also true that technology offers us several new alternatives that it is quiet convenient to start exploring, taking advantage of the documented knowledge of Pemex itself and other institutions which have a lot of well detailled and updated information of our national territory and its natural and energy resources, including generation and development potential of renewable and, alternative energy:

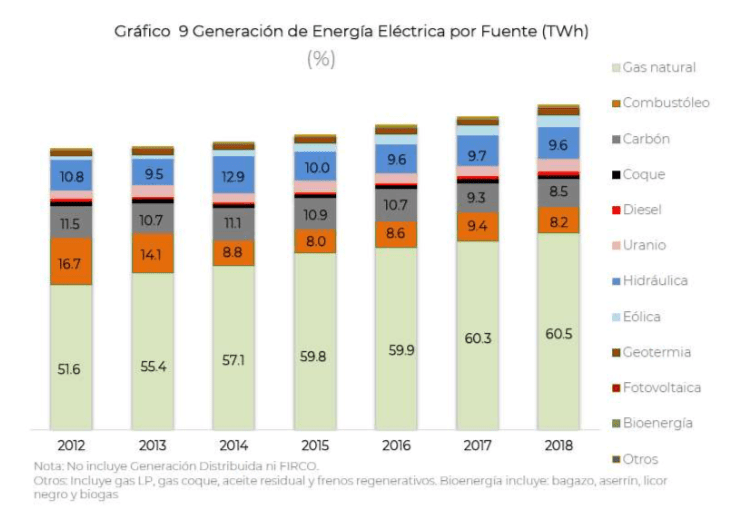

In the first instance, it should be considered that Mexico should not have any limitation in energy since it has vast Renewable, Non-renewable Natural resources and, an enormous generation capacity for practically all different types of energy sources, currently known. As an example, The following graph shows the different sources of energy generation that the Federal Electricity Commission exploited and commercialized in 2018:

On the other hand, it is enough to consider, in a quick analysis:

- More than 70% of Mexico’s territory is located within the Tropical Zone, so much of the country has a high rate of solar irradiation.

- Mexico has more than 10,000 km of coastline, which gives ample scope for the development of: Tidal power plants, wave energy developments and offshore wind fields.

- It has countless onshore wind ports (eg.- Salina Cruz, La Ventosa, La Rumorosa, etc)

- More than a geological dichotomy, Mexico has the three types of tectonic margins: In addition to the Subduction Zone that originates in the Eats of Mexico and that gives to the Sedimentary Basins, il Basins of the Gulf of Mexico and the Campeche Sound, in the Southwest, the Cocos plate meets the North American plate in the southern portion of the Sierra Madre Occidental, so that in addition to a vast potential of Mineral Resources, there is great tectonic activity and a great potential for geothermal energy and similar situation to the previous one, occurs in some places in the portion of the north of the Sierra Madre Occidental where we have effects of the rivera Plate Compression and also in the central part of Mexico, where the Traverse Volcanic Axis of the Mexican Republic cuts the North American plate.

- Mexico has an extensive hydrographic network, made up of surface and underground currents that, in fact, supports the various hydroelectric plants already in operation, which does not mean that this potential is exhausted and has practically not been exploited for small generation. However, there is currently the technology to generate enough energy for small isolated and independent installations.

- Biomass and biodigester generation is an equally under-exploited resource, despite the fact that in Mexico there are large communities whose main economic activity is agricultural industry in which waste disposal could be a benefit instead of representing a problema.

- And there are still other, more local or particular options such as: Cap gas in mining and coal mining áreas, Methane Gas in Esteros y Pantanos, Methane Hydrates, etc.

As it is evident, Mexico has multiple resources and alternatives to develop in energy matters, it also has vast knowledge, although it requires some kind of investment in technology and mass production.

One of the possible advantages is that different areas have different resources, so there are options to look for economic alternatives and savings in infrastructure for generation, storage and, transport/distribution.